Uber Technologies Inc. has been a major player in the ride-sharing and delivery services sector for years, continuously innovating and adapting to market changes. However, despite recent fiscal achievements, the company’s stock plummeted by approximately 7% in premarket trading following the release of its fourth-quarter financial results. This article dissects Uber’s performance, identifies the key challenges that lay ahead, and examines the implications for investors and consumers alike.

On the surface, Uber’s fourth-quarter results from last year appeared promising. The company reported earnings per share (EPS) of $3.21, significantly exceeding the expected 50 cents. Moreover, its revenue reached $11.96 billion, surpassing the anticipated $11.77 billion. This marked a notable year-over-year revenue growth of 20%, up from $9.9 billion. Such figures indicate robust operational performance and an ability to generate higher income, with a reported net income of $6.9 billion, rising sharply from $1.4 billion gained in the same timeframe a year prior.

However, the details behind these numbers reveal a more complex narrative. Uber’s impressive net income included a one-time tax valuation benefit of $6.4 billion and a $556 million pre-tax gain attributable to asset revaluations. Without these substantial boosts, the outlook could have appeared far less stellar. Additionally, adjusted EBITDA of $1.84 billion, while reflecting a 44% increase year over year, was merely in line with analyst expectations, raising questions about the sustainability of such rapid growth.

While the reported earnings might seem robust, Uber’s guidance for the upcoming quarter sparked concern among investors. For the first quarter, Uber projected gross bookings to be between $42 billion and $43.5 billion, slightly below market expectations. Similarly, the anticipated adjusted EBITDA range of $1.79 billion to $1.89 billion also fell short of analyst predictions of $1.85 billion. Consequently, these incongruities led to the downward adjustment of the company’s stock in the immediate aftermath of the earnings release.

The financial outlook suggests that while Uber is currently riding a wave of growth, there may be headwinds that could hinder future expansions. The company’s admission regarding its freight segment, which struggled to gain traction as consumer preferences shifted away from shipping goods and towards services post-pandemic, serves as a stark reminder of the challenges that lay ahead.

Despite the market’s mixed reactions, Uber continues to explore innovative avenues for growth. The announcement of its partnership with Waymo, aimed at launching a robotaxi service in Austin, Texas, signifies an ambitious step into the future of transportation. As urban areas become increasingly congested, the push for autonomous vehicle services could serve as a game-changer for the ride-sharing ecosystem.

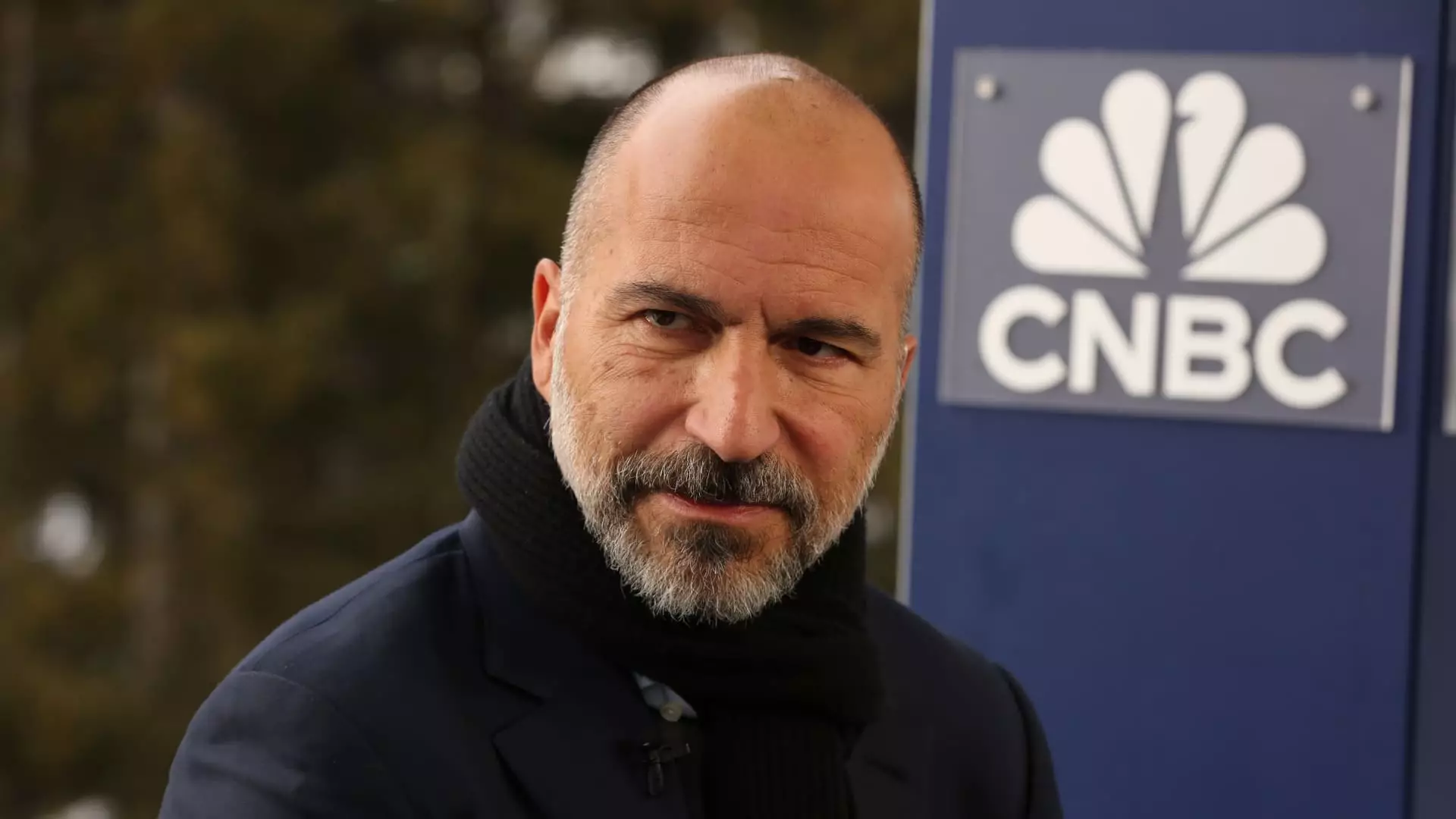

Uber CEO Dara Khosrowshahi stated that the company feels “clear momentum” heading into 2025, emphasizing the importance of ongoing innovation. This optimistic perspective is vital, especially as Uber prepares to formalize its foray into autonomous vehicles, which could reshape consumer transportation choices and dramatically reduce operating costs over time.

However, Uber’s potential for success in this new venture will heavily rely on the acceptance of autonomous vehicles by the public and regulatory bodies. The readiness of communities to embrace these innovative transportation methods will greatly influence the effectiveness of this initiative, posing an uncertainty that investors must consider.

While Uber’s quarterly performance showcased some impressive numbers, the broader implications of soft guidance, combined with challenges facing its freight segment, illustrate the complexities of navigating the contemporary market landscape. With innovation at the forefront, the potential for growth remains pronounced, particularly with robotic taxi initiatives on the horizon. Nevertheless, investors and stakeholders must remain vigilant and acknowledge that the road ahead is fraught with uncertainties. In a rapidly evolving industry, balancing short-term results with long-term strategic goals will be crucial for Uber’s sustained success.

Leave a Reply