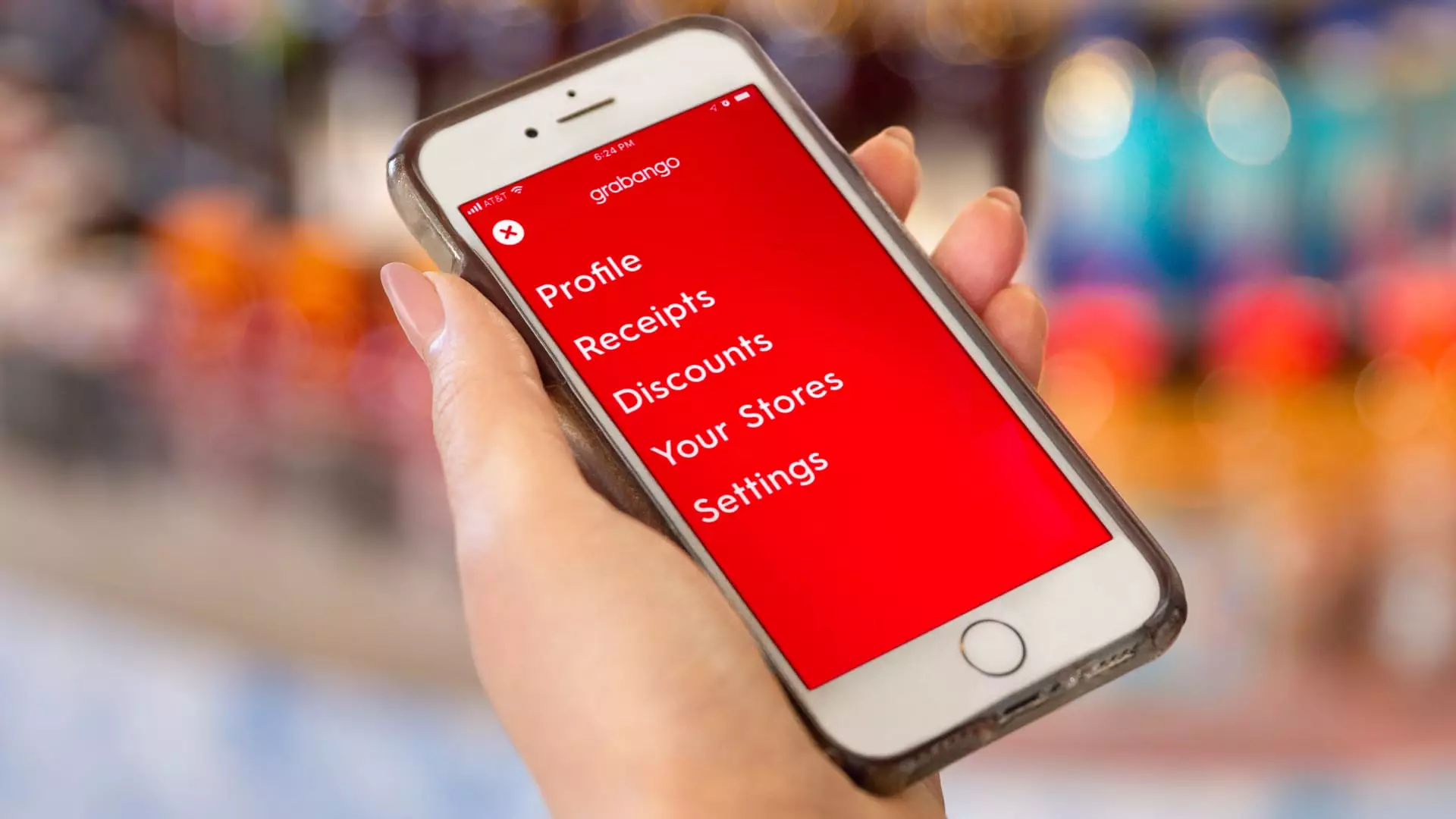

Grabango, a promising startup founded in 2016, emerged as one of the key players in the burgeoning arena of cashierless checkout technology. More than just a tech firm, Grabango focused on revolutionizing the shopping experience by integrating computer vision and machine learning to facilitate a seamless purchasing process. In its early days, Grabango garnered attention for its innovation-driven solutions aimed at enhancing customer satisfaction while reducing operational hassles for retail businesses. Despite its initial promise and a solid backing from venture capital, the company has sadly succumbed to the relentless pressures of an unforgiving market, ultimately shuttering its operations.

In a statement confirming its closure, a spokesperson from Grabango noted the disappointing inability to secure essential funding to sustain the business. The venture raised an estimated $73 million over its operational life, with its peak funding round occurring in June 2021 when it pulled in $39 million. However, as the venture capital landscape shifted dramatically due to varying market conditions—particularly since early 2022—Grabango was unable to navigate these changes successfully. The drying up of the IPO market, alongside a general decline in venture capital availability for startups outside the AI sphere, created an insurmountable barrier for Grabango’s continuation.

The company’s efforts to go public, rumored to bring a market cap between $10 billion and $15 billion, remained unfulfilled, underscoring how even the most visionary goals can be thwarted by external market dynamics. Such a fate serves as a somber reminder of the volatility inherent in startup culture, where even innovative ideas can falter without a sound financial foundation.

Emerging as a contender against retail behemoths like Amazon, Grabango’s innovative approach positioned it as a strong competitor in the cashierless checkout field. Amazon’s ‘Just Walk Out’ technology represented not only a formidable model of customer convenience but also a stark reminder of the challenges smaller firms face when going head-to-head with larger corporations that possess substantially greater resources. The competition didn’t just end there; other startups like AiFi and Trigo added further layers of rivalry in a market that was quickly becoming congested.

Despite securing notable partnerships with prominent retailers like Aldi and convenience networks such as 7-Eleven, Grabango faced hurdles in differentiating itself from its rivals. The technology landscape’s ruthless ever-evolving nature highlights the importance of sustained innovation, adaptability, and perhaps most importantly, financial stability for any tech venture aiming to compete effectively.

Grabango’s technological approach purportedly outstripped its competitors by favoring advanced computer vision algorithms over traditional shelf sensor technology, which the company’s founder Will Glaser described as an “Achilles’ heel” for Amazon. However, the practical implementation of such a sophisticated system entails substantial upfront investment and continuous enhancements to keep pace with consumer expectations.

Moreover, it is pertinent to consider whether Grabango’s strategy of pursuing large-scale retail partnerships with established brands was sustainable given the intensive competition present in the market. While established grocers and convenience chains can provide invaluable partnerships, reliance on a few major players may expose startups to significant operational risk and potential revenue fluctuations.

The downfall of Grabango encapsulates critical lessons for startups and investors alike. It underscores the necessity of having robust financial strategies and adaptive business models that can withstand market fluctuations. Moreover, even with groundbreaking technology, the ability to elevate and maintain competitive positioning amidst fierce rivalry merits keen focus.

In looking back at Grabango’s journey, stakeholders in the tech ecosystem should recognize that success is not merely determined by innovation but is interwoven with funding availability, market trends, and the capacity to adapt strategies to shifting landscapes. Ultimately, Grabango’s rise and fall serves as both a cautionary tale and a source of inspiration for future entrepreneurs, embodying the spirit of innovation that drives progress, yet also highlighting the intricate interplay between vision and the reality of the marketplace.

Leave a Reply