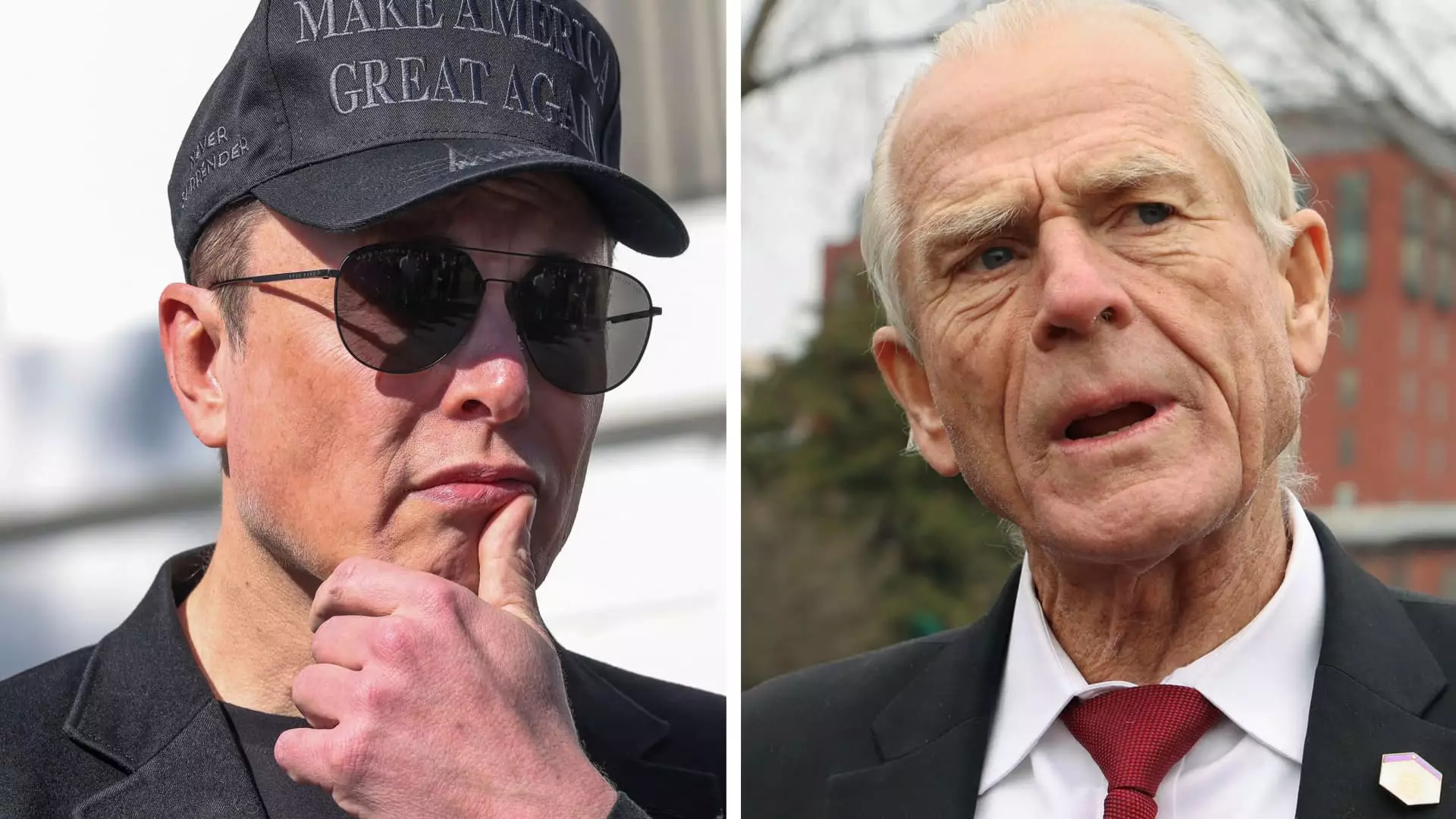

Tesla’s recent struggles in the stock market have triggered an unexpected impetus for friction between two powerful personalities: CEO Elon Musk and former White House trade advisor Peter Navarro. As Tesla shares continued their descent—plummeting for a fourth consecutive day—Musk lashed out at Navarro on social media. He criticized Navarro’s renowned academic credentials from Harvard, suggesting that they did more harm than good to his understanding of economic matters. This public spat not only lays bare personal animosities but also the complexities of corporate governance amid controversial trade policies that are affecting Tesla’s market positioning.

Musk’s tweets escalated quickly; he even described Navarro as “dangerously dumb” and “dumber than a sack of bricks.” Such harsh language indicates not only Musk’s frustrations with Navarro’s interpretations of trade but also hints at the stakes involved. Having lost billions in personal wealth due to a significant drop in Tesla’s market valuation, Musk’s emotions reflect the pressures that encircle him as a business leader and a public figure. The contentious remarks serve as both a personal grievance and a strategic defense against criticisms aimed at Tesla’s operations.

The Broader Economic Context

Musk’s vitriol cannot be detached from the broader economic implications created by the tariffs imposed on imports. President Trump’s recent announcement of steeper tariffs on an extensive range of goods from over 180 countries has created unease, particularly in the automotive sector where Tesla operates. While it was initially believed that Tesla’s domestic assembly would cushion the company against these tariffs, escalating costs for materials imported from Mexico and Canada threaten to impact production. The situation points to a critical intersection where public policy and corporate strategy clash, raising questions regarding Musk’s future as a strategic leader for Tesla.

In recent days, one might wonder if Musk’s vocal exchanges are more than mere banter. They appear to reflect a deeper issue within the administration regarding trade policy and its implications for American businesses. During a briefing, White House Press Secretary Karoline Leavitt downplayed the feud, commenting on the differences in their perspectives on trade without adequately acknowledging the potential fallout on American companies. By dismissing the conflict as mere child’s play, the administration might be undermining the serious economic implications that turbulent trade relations can inflict on the economy.

A Personal Perspective: Musk’s Vulnerability

While some may perceive Musk’s character as invulnerable, recent developments expose the cracks in his empire. The sheer scale of Tesla’s stock market losses—over 45% this year, equating to a staggering $585 billion in market value—casts a shadow on Musk’s larger-than-life persona. Despite his involvement in various ventures including SpaceX and the social media platform X, it appears that the mounting financial pressures could be weighing heavily on him. This vulnerability is reminiscent of an athlete who thrives on the field but falters under the weight of an unyielding scoreboard.

The dishonor that accompanies stock declines and public spats exemplifies the volatility inherent not only in Musk’s investments but in his public demeanor. Reflecting on the recent boycott and protests against Tesla stemming from Musk’s political rhetoric, one has to consider the potential backlash that comes with his outspoken nature. There is an undeniable risk in being polarizing; public sentiment can shift as quickly as stock prices.

Reimagining Trade Relations

Among his various concerns, Musk expressed a desire for a zero-tariff landscape between Europe and North America, showcasing a notable deviation from the current administration’s policies. His vision of a free trade zone draws attention to the discord between business interests and political attitudes. Despite Musk’s high-profile connections to the White House, he is advocating for an approach that aligns with his corporate strategy rather than political affiliation.

Given Tesla’s significant investments in Europe and its ambitious plans for expansion—highlighted by the Berlin Gigafactory—it seems plausible that Musk is attempting to steer the conversation towards a constructive dialogue about trade regulations that can benefit innovative American businesses. However, the uphill battle remains formidable; seemingly entrenched ideologies about protectionism within the administration are not about to vanish overnight. As Musk continues to navigate this tumultuous landscape, all eyes will be on how he manages both his company’s fortunes and his public persona.

Leave a Reply