Nvidia is slated to announce its fourth-quarter earnings on Wednesday, and investors are anxiously awaiting the results. According to estimates from LSEG consensus, analysts project earnings per share (EPS) of $0.84 and a staggering $38.04 billion in revenue. This forthcoming earnings report will provide a timeline on an extraordinary growth trajectory that Nvidia has maintained over the past year. They have become synonymous with the explosion of interest in artificial intelligence (AI), largely driven by the indispensable role their graphics processing units (GPUs) play in this field.

In a year anticipated to be unprecedented for the company, a remarkable 72% surge in quarterly revenue for the period ending January is on the horizon. Projections estimate that Nvidia’s total revenue for the fiscal year could exceed an astonishing $130 billion, more than double the previous fiscal year’s figures. The company’s impressive sales can be attributed to the explosive demand for GPUs essential for developing and deploying AI applications, such as OpenAI’s groundbreaking ChatGPT. These impressive statistics reveal that Nvidia has solidified its position as an industry leader—a sentiment corroborated by its share price soaring over 440% within just two years.

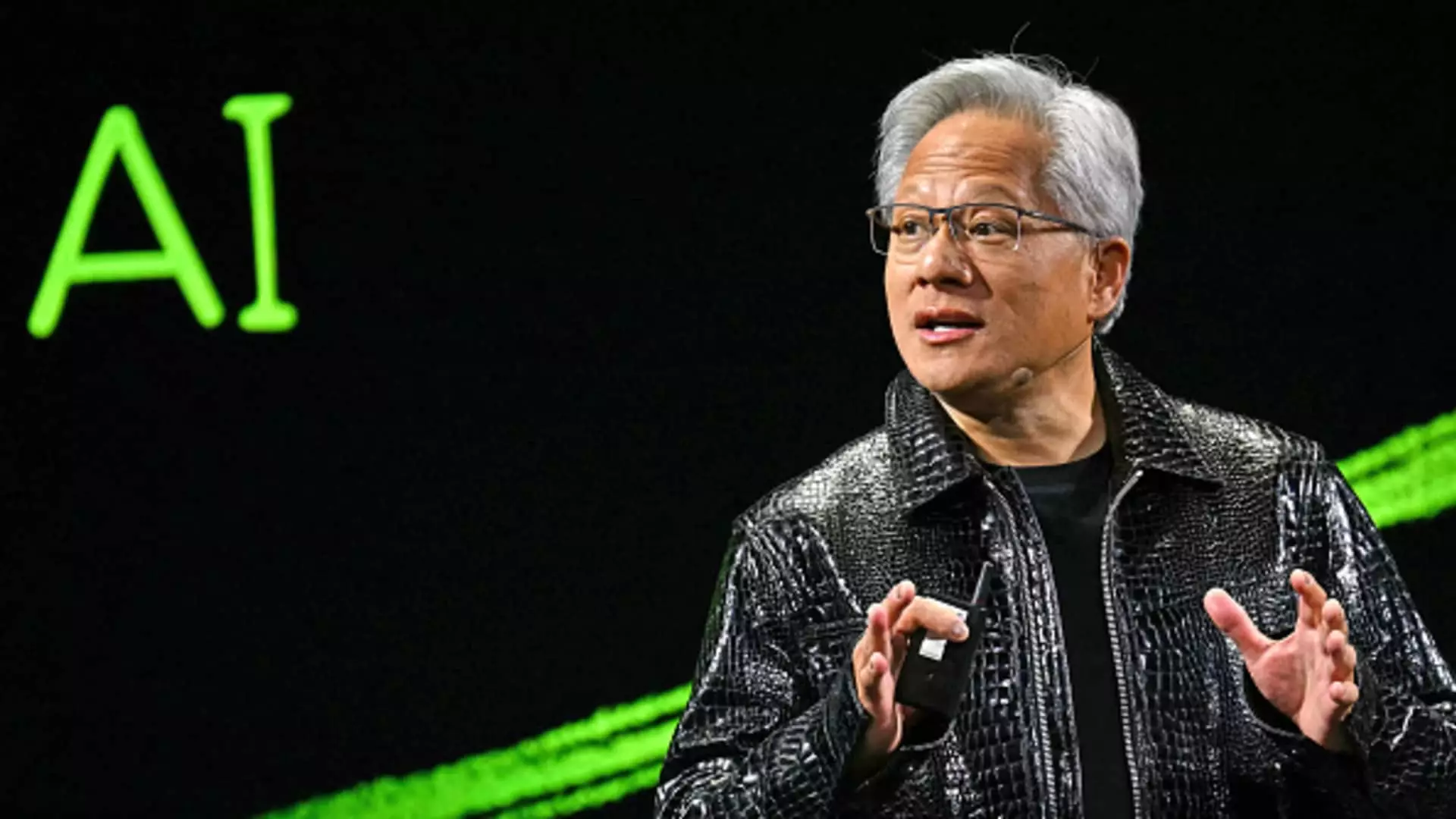

However, the euphoria surrounding Nvidia’s meteoric rise has recently met headwinds. The stock price has stalled, remaining at levels comparable to last October, igniting concerns amongst investors regarding its future trajectory. Questions are increasingly being raised about what Nvidia’s plans entail moving forward and whether the current growth can be sustained. During the upcoming earnings call, Nvidia’s founder and CEO, Jensen Huang, faces the crucial task of addressing these investor concerns, particularly regarding the longevity of the AI boom.

A pressing concern for stakeholders is the spending habits of Nvidia’s primary clients—hyperscale cloud firms. These companies have historically invested heavily in AI infrastructure, but signs suggest that they may start tightening their budgets after years of expansive capital investment. The emergence of a Chinese AI model called DeepSeek’s R1 has further complicated the landscape, leading to questions about whether the demand for Nvidia’s chips will remain robust. If U.S. officials decide to impose stricter regulations limiting Nvidia’s chip exports to China, this could impact the company significantly, as it’s already constrained in selling its most advanced products to the region.

Equally significant for investors is the performance of Nvidia’s latest AI chip, Blackwell. Reports indicate that the rollout has encountered challenges linked to distribution delays, thanks to overheating and yield issues. Recent analyses by Morgan Stanley suggest that key players like Microsoft will account for a whopping 35% of projected spending in 2025 on these chips. Consequently, any slowdown in their infrastructure spending would signal potential turbulence for Nvidia. Despite this, Microsoft countered fears by announcing a commitment to an $80 billion infrastructure spend in 2025, indicating their ongoing demand for Nvidia’s technology.

Responses from Major Players

Tech giants such as Alphabet, Meta, and Amazon have outlined hefty capital expenditure plans, further reassuring stakeholders about AI infrastructure investments. Alphabet has earmarked $75 billion, Meta intends to spend up to $65 billion, while Amazon is eyeing a whopping $100 billion in expenditures. These commitments fuel the optimism that Nvidia’s business will remain solid and adaptable even as it navigates a changing market landscape.

As Nvidia prepares to unveil its earnings report, all eyes will be on the guidance for fiscal 2026. Investors will be keen to glean insights into expected growth relative to last year’s elevated sales figures. The market’s response hinges on affirmations of Nvidia’s strong relationships with cloud service providers and its ability to sustain the relentless pace of growth that has characterized its recent success. Amid uncertainties, Nvidia stands at a pivotal juncture, facing the challenge of evolving market dynamics while striving to maintain its leadership in the AI space.

Leave a Reply