As Australia embarks on its journey towards a sustainable, net-zero future, hydrogen emerges as a pivotal element in this transition. The newly released National Hydrogen Strategy, presented by the Federal Climate Change and Energy Minister Chris Bowen, outlines a crucial roadmap aiming to position Australia as a global leader in low-emissions technology. The strategic document emphasizes the critical importance of green hydrogen production, with objectives centered around achieving competitive costs and attracting substantial investments. This national endeavor not only seeks to foster an industry that produces hydrogen sustainably but also to communicate Australia’s ambitious intentions on the global energy stage.

This updated strategy marks a significant evolution from the initial framework introduced in 2019, led by then Chief Scientist Alan Finkel. The advancements made are noteworthy, as the current strategy reflects adaptations to the evolving energy landscape and climate imperatives. While the previous document laid the foundational principles for hydrogen production, this new version aims for more concrete goals, including ambitious production targets. However, the updated strategy does not come without ambiguity—questions linger regarding the extent to which it integrates with existing policies and the financial implications of taxpayer investment in potentially unviable hydrogen projects.

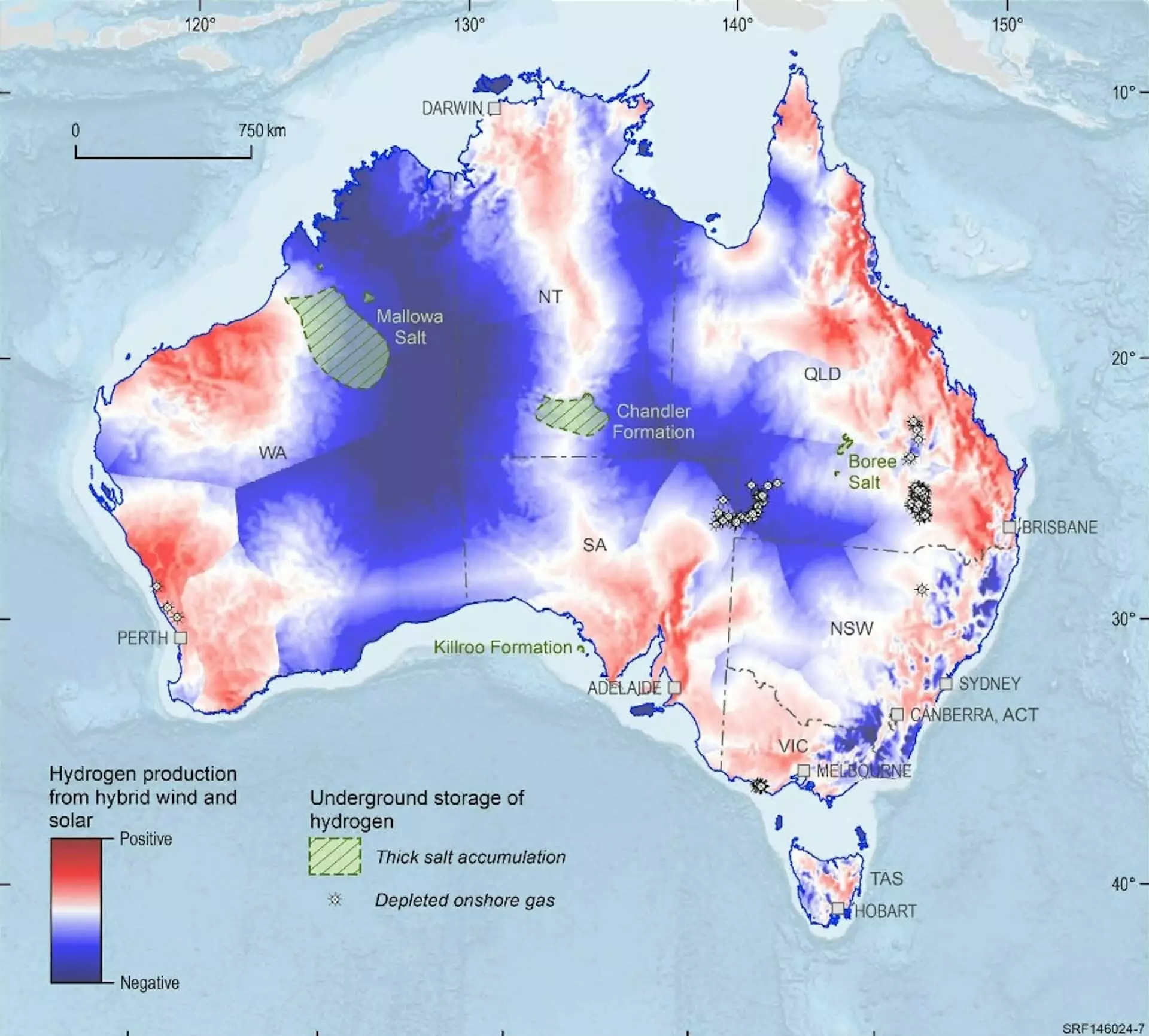

Hydrogen, the most abundant element in the universe, possesses the potential to transform several sectors, including steel and chemical manufacturing, replacing fossil fuels in a zero-emission manner. It also offers a means to store electricity, contributing to energy security and performance. Nonetheless, the reality is that Australia’s current hydrogen production largely relies on natural gas, which contributes significantly to greenhouse gas emissions. The challenge ahead lies in transitioning from conventional methods to producing what is termed “green hydrogen,” encompassing processes powered entirely by renewable energy.

The journey toward establishing a robust green hydrogen industry is riddled with hurdles, particularly economic constraints. Currently, the expenses associated with producing green hydrogen are elevated, deterring majority buyers from participating. To address this, the strategy outlines specific production targets of 500,000 metric tons by 2030 and 15 million metric tons by 2050, with ‘stretch targets’ of 1.5 million and 30 million metric tons, respectively. Achieving these goals would necessitate not only scaling production but also identifying and cultivating new markets for hydrogen.

Notably, the updated strategy opts to discard a previous target from the former administration that aimed for hydrogen production to fall below $2 per kilogram. This decision reflects an understanding that such benchmarks did not account for the multifaceted cost dynamics of hydrogen, including transportation, storage constraints, and the technology implications for its usage. Any effective approach to hydrogen production must align realistic expectations with strategic governmental policy choices, which ultimately dictate whether these ambitious targets can be realized.

The new strategy further identifies three key industries—iron, alumina, and ammonia—where hydrogen can foster the creation of export-oriented industries. Additionally, it outlines potential emission reduction areas, including aviation and shipping, electricity storage, and heavy freight. This refined approach demystifies some of hydrogen’s limitations while guiding priorities into more feasible realms. Nevertheless, uncertainties remain regarding how these prioritized sectors will be supported, particularly concerning funding or infrastructure aid, which could affect investor confidence and commitment.

A striking comparison exists between this new strategy and its predecessor, particularly concerning potential export markets. While the prior approach focused on liquid hydrogen exports to Japan and South Korea, the present strategy recognizes Europe as a significant prospective market. Recent announcements, including a joint initiative between Australia and Germany to forge a $660 million green hydrogen deal, underscore this pivot towards European partnerships. However, challenges surrounding hydrogen transportation costs raise essential considerations regarding feasibility.

In response to public safety concerns historically associated with hydrogen, the strategy places emphasis on community acceptance and benefits. It acknowledges the risks of employing hydrogen technologies but also aims to cultivate a landscape of job creation and diversified regional economies. In prioritizing community consultation, particularly with First Nations groups, the updated plan recognizes potential social implications stemming from hydrogen developments.

This National Hydrogen Strategy intersects with several recent government initiatives, such as a $2 billion Hydrogen Headstart program and a tax incentives framework aimed at hydrogen producers. However, the efficacy of these funding mechanisms remains to be critically assessed, especially concerning their alignment with priority sectors and overall objectives. As the strategic focus evolves, a continuous review mechanism is embedded within the framework, with a planned evaluation in 2029.

For the strategy to be deemed successful, tangible developments need to manifest—these could include large-scale projects moving into construction phases, suppliers forging long-term contracts, and essential infrastructure like hydrogen storage facilities being established. Should these indicators not materialize over the next decade, Australia may need to reassess its hydrogen strategy and broader aspirations within the global energy landscape, ensuring a resilient and adaptable approach to sustainable energy production and consumption.

Leave a Reply